After his bestseller Capital in the 21st Century, the French star economist Thomas Piketty published his new monumental book. It is about the history of inequality and the vision of a more just society. The book is currently only available in French and will be published in English in March 2020. Here is a summary of the most important theses of Piketty’s Capital and Ideology.

Read this article in German here.

1. THE POST-WAR SOCIAL DEMOCRATIC ERA WAS A GOLDEN ERA. WHY? REDISTRIBUTION!

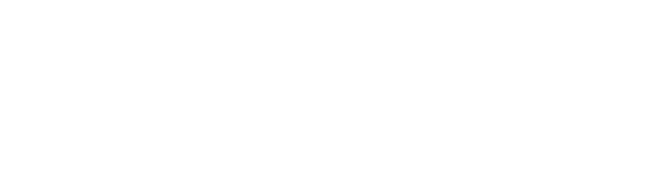

Piketty starts his historical analysis in the feudal period and then defines three more epochs: The rentier society (from the French Revolution to the end of the Second World War), the social democratic society (from 1945 to the 1980s) and the neo-rentier society (from the 1980s to today).

With the exception of The social democratic society – from 1945 to the 1980s – all epochs from the Middle Ages onwards were marked by extreme inequality.

The rich became richer and richer, the poor poorer. In addition, the rich paid hardly any taxes in all the unequal epochs; the working people were the ones who bore almost the entire tax burden. This is true for the Middle Ages, when the nobles were tax-exempt – just as it is for today, when the rich hide their wealth in offshore accounts from tax authorities.

Only in the Social Democratic era was it possible to defuse this contradiction:

In the 1950s, the distribution of income and wealth was more balanced than ever before in modern history. That remained stable for over thirty years.

Strongly progressive income and inheritance taxes ensured that the rich contributed more to society and that wealth was not concentrated in their hands as much as it had been in the past. Until the 1980s, the highest income tax rate in the United States was 81 percent, in Great Britain it was even as high as 89 percent.

Since the 1980s, top income tax rates have fallen steadily.

By comparison, the highest income tax rate in Austria of 55% is today one of the highest in the EU. During the social democratic period, politicians invested the money generated from tax revenues in education and health. This was of particular benefit to middle and lower income groups and increased social equality as well.

2. NEW INEQUALITY THROUGH DEREGULATION AND TAX GIFTS FOR THE RICH

Towards the end of the 1980s, the neo-rentier society replaced the golden era of the social democratic society. Taxes for the rich and corporations were lowered – the working population again bore most of the tax burden. Neo-liberals and conservatives abolished inheritance taxes, wealth was once more concentrated in a few families. This lead to an increase in the overall level of inequality. Government spending – such as on education – has modified to benefit the social elites, not the general public.

In Capital and Ideology, Piketty shows that social inequality has increased worldwide since the end of the social democratic phase.

In addition, the deregulation of the international financial system has led many rich people to park their wealth in tax havens. The lack of control over international capital flows allowed them to hide their money from tax authorities in tax havens such as Panama or the Cayman Islands.

As a result, the rich avoided paying even the little taxes they were supposed to pay.

The lowering of taxes for the rich was combined with cuts to the welfare system. These cuts affected mostly small and medium income families, exactly the groups who were already shouldering most of the tax burden.

This trend of increasing inequality was also the main topic of Piketty’s last bestseller, Capital in the 21st Century. Due to popularity of the book and the importance of its message, the director Justin Pemberton made it into a film.

3. SOCIAL DEMOCRATIC PARTIES HAVE CEASED TO BE WORKERS’ PARTIES

For Piketty, there are several reasons why the social democratic era came to an end and high levels of inequality returned. For example, the end of the Soviet Union and the transformation of the former Eastern bloc states into a laboratory for hyper-capitalism. His analysis, however, focuses primarily on changes in electoral behaviour, where he identifies two massive changes.

- First, voter turnout is falling – but not evenly across all social classes. While the wealthy continue to participate actively in political life, voters from the lower classes tend to turn away from it.

- Second, the social origin of right-wing and left-wing voters has changed. In the past, the rich voted primarily for right-wing parties, while voters from poorer backgrounds usually supported left-wing parties. Today it is often the other way round: while the working class votes mainly for the right, the left voters are mostly from the educated middle class.

4. THE TWO LINES OF CONFLICT: CLASS AND IDENTITY

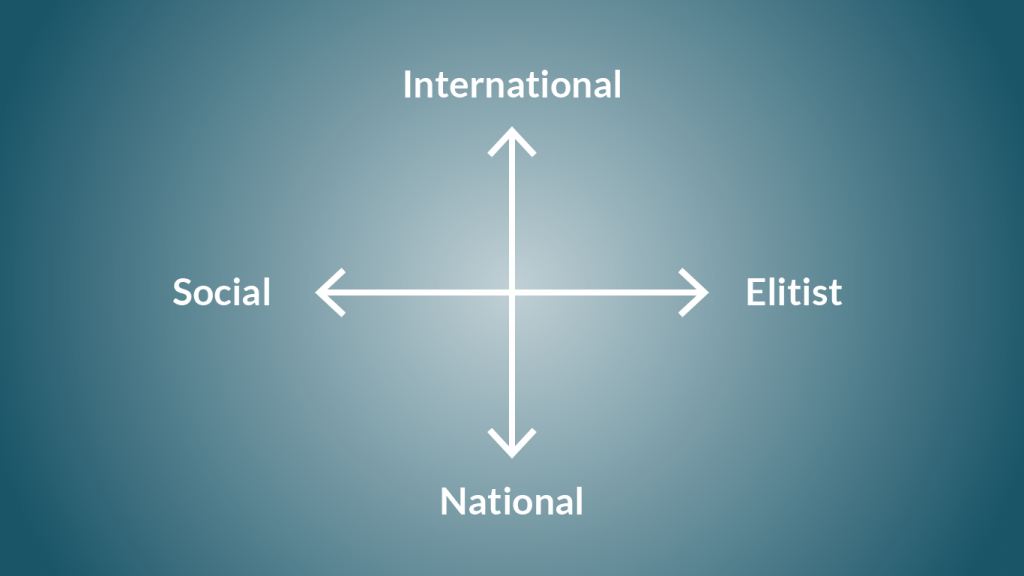

For Piketty, both identity and class are the main lines of conflict in our society. It follows that simply differentiating between left and right is no longer sufficient. There are four political camps today: social internationalists, social nationalists, elitist internationalists and elitist nationalists.

A left that relegates class conflict to the background runs the risk of losing working class votes to right-wing parties. Especially when these right-wing parties are able to develop a form of social nationalism and win the votes of the working class. The success of the FPÖ under the idea of the “social patriotic party” is a good example for this.

5. PARTICIPATORY SOCIALISM AS NEW LEFT POLITICS. A VISION OF PIKETTY

In Capital and Ideology, however, Piketty outlines a way in which the right can be defeated and the rampant social inequality reduced. He calls this new path “participative socialism” and builds it on three pillars:

- Codetermination at the workplace

- Nationalization

- Tax progression.

Thomas Piketty builds upon the Central and Northern European model of social partnership but he wants to push the codetermination even further. Workers should have more say in the management of their companies. This private sector with strong co-determination should stand alongside a strong public sector. The state should organise education, health and infrastructure, not the market.

However, Piketty’s most radical demand concerns the tax system:

He advocates a top income tax rate of 90 percent. In addition, he argues for a wealth tax that is higher than the average increase in wealth. This would reduce wealth inequality instead of increasing it.

With the tax income from wealth taxes, each citizen gets an unconditional capital stock. The capital stock should be 60 percent of the average wealth and would be paid to everyone on their 25th birthday, according to Piketty’s proposal. For every Austrian that would be a share capital of €120,000. That would be the democratisation of wealth.

Thomas Piketty

The 44-year-old star economist Thomas Piketty earned his doctorate in economics at the age of 22 and became a professor at the Massachusetts Institute of Technology at the age of 26. He is a founding director of the Paris School of Economics and is also active at the École des Hautes Études en Sciences Sociales (EHESS). His research focuses on social inequality and question of how we can create a fairer economic order. In 2014, Piketty published Capital in the 21st Century and became world famous. Capital and Ideology is his new monumental work.