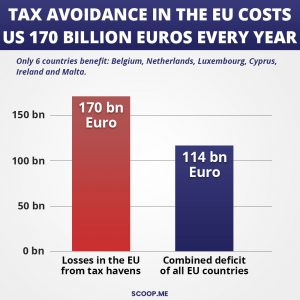

Transnational companies with billions in sales often pay lower taxes than their employees. A study presented at the World Economic Forum in Davos now shows: The EU member states lose 170 billion euros annually through corporations and rich individuals avoiding taxes. Big companies use all sorts of tricks to minimize taxes and maximize profits. Here is how tax avoidance works and what can be done to end it.

Imagine: In one fell swoop, the entire annual deficit of all EU states is wiped out and there are still 56 billion euros left free to spend. Imagine: Europe is able to invest extra billions and billions of euros in climate protection, education, health care or public transport. This is exactly what happens if Europe finally fights tax avoidance and tax evasion.

Europe loses 170 billion euros due to tax avoidance

A study of the Polish Economic Institute recently presented at the World Economic Forum in Davos shows shocking results: EU member states lose a total of 170 billion euros – every year. Tax avoidance is a multilevel issue. 60 of the 170 billions are lost due to artificial profit shifting by multinational companies. 46 billion euros due to moving wealth by rich individuals and 64 billion due to cross-border VAT frauds.

And it is getting worse. The average corporate income taxation in the EU falls throughout the past two decades from 24% in 2000 to 16% in 2017. Only six countries benefit from tax avoidance: Belgium, Cyprus, Ireland, Luxembourg, Malta and the Netherlands.

Companies shift profits and found subsidiaries

A common method to avoid paying taxes involves shifting profits to low-tax countries and tax havens. This means: Even if a company is stated in Germany and makes sales and profits there, it could shift profits to low-tax countries such as Cyprus, where the tax rate is only 12.5 per cent.

To do so, companies found subsidiaries in low-tax countries. Those subsidiaries charge their parent companies overpriced services, such as fees for licenses, trademark or naming rights, technical know-how or supply with raw material. As a result, profits of the parent companies – and therefore the taxable amount of money – diminish and instead flow to the subsidiaries. In the end, the states, where the parent companies are stated, lose billions of legitimate tax income.

Consulting firms assist willfully

Large and international accountancy and auditing firms such as PricewaterhouseCoopers, Ernst & Young, Deloitte or KPMG assist in tax avoiding methods. They advertise measures to “optimize” tax payments from major customers.

Richard Murphy is professor of International Political Economics at the City University of London. He classifies these measures as a threat to democracy:

Accountancy firms, according to Murphy, support tax evasion. The consequences are that one state after another is facing deficits. The resulting costs are burdened on those who rely on benefits of the welfare state.

How to end tax avoidance in the EU

How can Europe end tax avoidance and tax evasion? The Polish Economic Institute recommends several actions in its study, for example:

- Including the EU Member States in the screening process for the grey- and blacklist of tax havens.

- Giving the European Commission the power to impose sanctions on countries that have been classified as tax havens

- Introducing compensatory taxation at the EU level. That means a minimum tax paid by multinational enterprises in each EU Member State they operate in.

- Introducing solidarity in fighting tax evasion to the mainstream political agenda in the EU.

Nobel Prize recipient proposes global tax

Support comes from Joseph Stiglitz, American economist and recipient of the Nobel Prize. He proposes a global minimum tax of about 25% that is able to end the current race to the bottom. Stiglitz says: